📈 Top 10 Stock Lists

Join the conversation

📈 Top Daily Gainers

📈 YTD Gainers

📉 Top Daily Losers

💰 High Dividend Yields

📅 Best Performers – September

✅ Seasonal Standouts – September

🔮 Seasonal Standouts – October

$20bn Rise in Australia's Budget Surplus

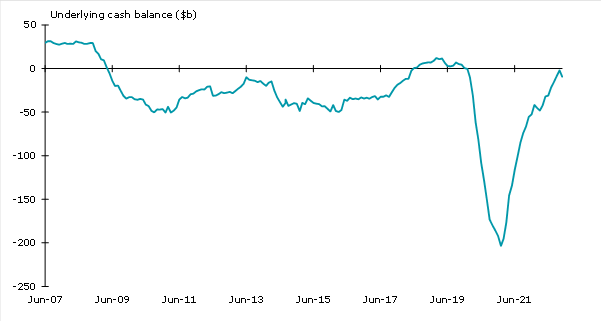

Australia's budget surplus has experienced an unexpected boom, reaching a whopping $20 billion. This significant rise is largely due to an increase in tax revenue and a surge in mining profits.

The revised budget estimate for 2022-2023 was initially an underlying cash surplus of $4.2 billion. However, Treasurer Jim Chalmers stated that the final budget outcome likely surpassed expectations. This surplus represents Australia's first in 15 years.

This surplus was not achieved through mere budgetary "savings" alone. Rather, strong job growth and bumper mining profits played major roles in swelling the country's coffers. High global demand for Australia's iron ore and a steady rise in employment rates significantly contributed to this achievement.

While this surplus is an undeniable victory, it also holds implications for future fiscal management and government strategy. It should be seen as a stepping stone towards forging a stronger financial foundation and a source of funding for new initiative.

The present surplus will not only bolster economic stability, but also allow the government to enhance its policies and services. This includes potentially addressing cost of living pressures, tackling inflation issues, and reducing unemployment.

Facing the uncertainties of the global economic climate, Australia's remarkable budget surplus serves as a safety net and a source of optimism for its economy.

Tendies_Inbound

1y

#ASX:ASN Is Anson Resources’ US$330M Financing Deal the Key to Unlocking Utah’s Lithium Potential?