Who is the Management Team behind Anson Resources?

Anson Resources Limited (ASX: ASN) stands as a beacon in the quest for sustainable energy solutions, driving exploration and development initiatives for the clean energy future.

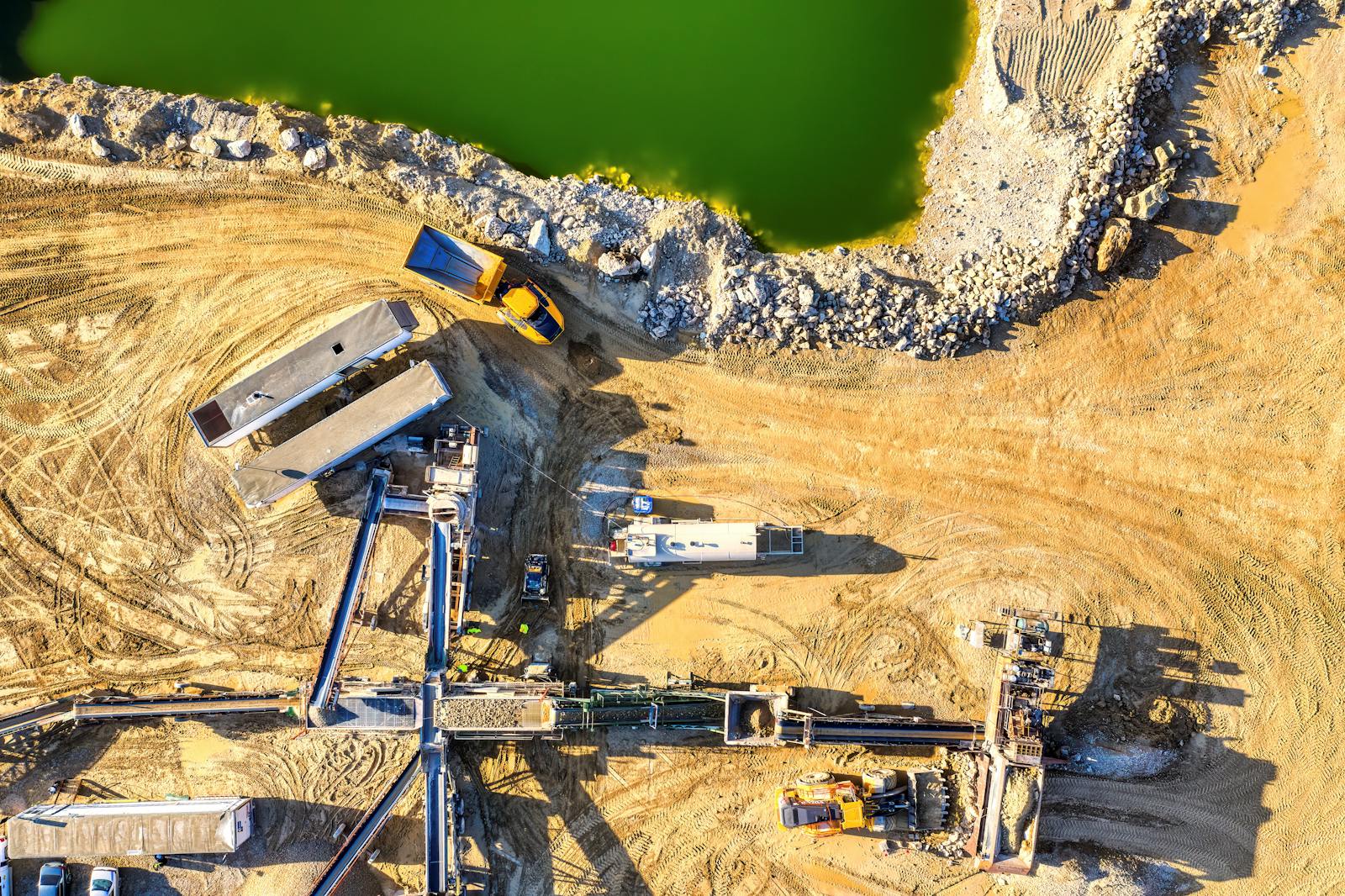

Focused on the Paradox Lithium Project in the Paradox Basin, Southern Utah, Anson is on a mission to transform this region into a pivotal hub for lithium production, serving the burgeoning global Electric Vehicle (EV) battery market. Beyond lithium, the company seeks to harness valuable bromine resources, marking a commitment to multifaceted clean energy solutions.

Project Expansion and Exploration

Anson's endeavors extend beyond Paradox with its strategic expansion into the Green River Lithium Project. Recognizing geological resemblances with the Paradox Project, Anson is fast-tracking exploration and development in Green River. The objective is clear: bolster the Mineral Resource base in the Paradox Basin to fortify the anticipated lithium production operations.

Diverse Portfolio and Expert Leadership

The company boasts a diverse portfolio of exploration assets, including the Yellow Cat Uranium Project in Utah and multiple base and critical metals exploration ventures in Western Australia's Yilgarn Craton.

Story Continues.. after this ad because we need some dollarydoos

Anchored by a formidable leadership team, Anson Resources is steered by Bruce Richardson, an industry veteran with over three decades of experience, particularly in China, nurturing business and political relationships in the resources sector.

Expertise Enriching Leadership

Richardson's proficiency in Mandarin, coupled with his extensive experience in both private and public sectors, reflects Anson's global approach and rich industry understanding. He brings forth a wealth of knowledge cultivated through senior positions in blue-chip companies and pivotal government roles, strategically positioning Anson within the global resources landscape.

Leadership Reinforced

Complementing Richardson's adept leadership, Anson Resources boasts an accomplished executive team. Notably, Nicholas Ong, a former ASX Principal Advisor, brings invaluable insights into listings and financial markets.

CFO Matthew Beattie's financial acumen, honed at Rio Tinto and private equity funds, bolsters Anson's project delivery expertise. Meanwhile, COO Tim Murray, a seasoned professional with profound insight into the Chinese market, adds a nuanced understanding of commodity trends and the evolving lithium industry.

Anson Resources pursuit of clean energy solutions, its visionary leadership, and strategic exploration initiatives position the company at the vanguard of sustainable resource development. With a focus on lithium and other critical metals, Anson stands poised to propel the clean energy movement, bridging the gap between resource exploration and a greener tomorrow.

Promote your business on our growing investor platform: Advertise With Us

📈 Top 10 Stock Lists

Join the conversation

📈 Top Daily Gainers

📈 YTD Gainers

📉 Top Daily Losers

💰 High Dividend Yields

📅 Best Performers – November

✅ Seasonal Standouts – November

🔮 Seasonal Standouts – December